Life happens. Sometimes we make mistakes that affect our credit.

Fortunately, the mistakes don't have to have long-lasting effects. There are many ways you can improve your credit score in 30 days — you just need to know what to do.

But credit is a long game. It's going to be rather difficult, if not impossible, to get a 700 credit score in 30 days if you're starting at the lower end of the credit range. After all, most lenders only report activity to the credit bureaus once a month.

That being said, different lenders may report at different times over the course of a month, so depending on how many lines of credit you're juggling, it's possible your score will change more than once a month. Regardless, if you want to see significant, sustained improvement to your credit score, you're going to have to remain diligent longterm. Any progress could be easily erased with a missed payment or two.

Featured tools for improving your credit score

What is a good credit score?

Credit scores can range from 300 to 850, depending on the reporting agency. The credit score ranges are excellent, good, fair, and poor — but the main thing to know is that the higher your number, the better. A good credit score is in the 700+ range for the FICO and VantageScore.

To increase your chances of qualifying for the best rates and terms on things like auto loans and credit cards, aim for a score in the 750+ range. At a minimum, keeping your score over 620 can put you in a place where you'll be more likely to qualify for most loans and credit cards.

10 strategies that could improve your credit score in 30 days

I understand the feelings you have when you've made a few financial mistakes. It's easy to feel like you've ruined your financial future, but the good news is that you haven't.

1. Pay bills on time

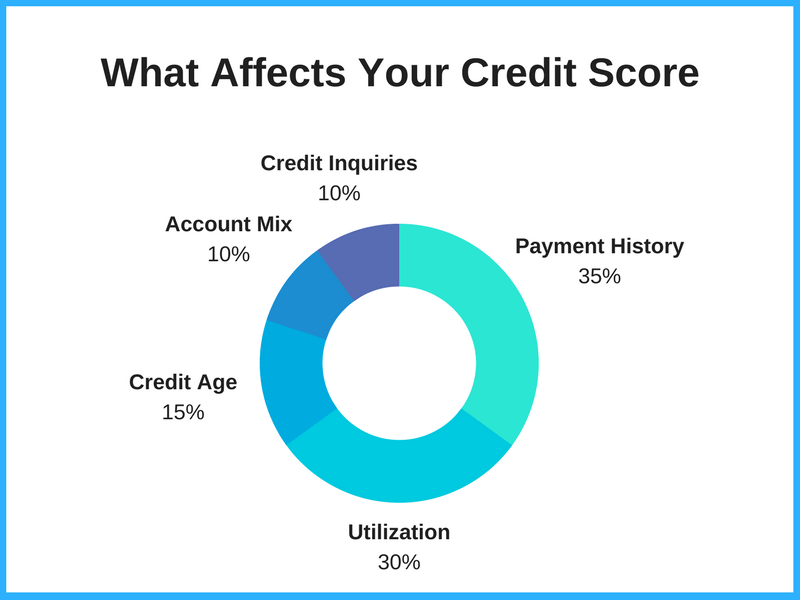

Paying your bills on time is the number one way to increase your credit score. Your payment history makes up 30-35% of your total score, so missing monthly payments or making late payments can drop your score significantly. Conversely, a good payment history could increase your score.

Don't worry—you don't have to make large payments; just the minimum amount due by the due date will help your credit score. Lenders want to see that they can trust you by seeing an on-time payment history.

Consider the bills to put on autopay to reduce the risk of late payments. You can set this up directly through your bank and eliminate the risk of making late payments.

2. Check your credit score regularly

Many people think checking your credit score lowers it, but this isn't true. Checking your credit score is one of the best ways to stay on top of your credit health and see what factors impact your score. This is especially important if you decide to borrow money, like a new credit card or a personal loan, as your credit score will help you understand your chances of approval.

If you sign up for a credit monitoring tool like Credit Karma, you'll get free access to your credit score, reports, and monitoring. Knowing your score may help you make different or better credit decisions, allowing your credit score to increase as a result. Some of the best budgeting apps also help you track your credit score, like Quicken Simplifi, for example.

3. Make sure your credit report is accurate

You should check your credit report at least twice a year or more often if you have reason to worry. Fortunately, you can request one free credit report weekly from all three major credit bureaus — Transunion, Equifax, and Experian by visiting AnnualCreditReport.com.

If you find errors, you could considerably raise your score if you report them immediately. For instance, if you notice that the same debt is listed twice, removing this inaccurate information can lower the amount of debt listed on your credit report, which could, in turn, increase your score. This can make a big difference since credit utilization, a measure of how much credit you use with relation to how much you have available to use, typically makes up 20 to 30% of your score.

Take the time to read your report carefully. Look for old debt that should have been removed, information that isn't yours, and fraudulent charges. If you find an error, inform each of the three credit bureaus and provide any proof you have of the error.

4. Use credit cards responsibly

Aside from earning cash back or travel rewards, credit cards could be a great tool to build credit — if used responsibly. As effective as a credit card could be for raising your score, it could just as easily damage your credit.

The key ways a credit card can help build your score include:

- Paying at least the minimum payment by the due date every month

- Keeping your outstanding balance at 30% or less of your available credit line

5. Pay down a credit card or loan

As I said earlier, keeping your credit utilization below 30% may help increase your credit score. Credit utilization is the amount of potential credit you have versus how much of that credit line you have outstanding. In other words, it measures whether you've maxed out your credit cards or have ample breathing room.

There are several different arguments regarding strategies for paying off credit card debt. Some experts say you pay off the one with the lowest balance first (this is called the snowball method), while other experts say to target the card with the highest credit card interest rate to save the most money (this is called the avalanche method).

If you want to increase the likelihood of your credit score going up, I suggest paying down the credit card currently closest to being maxed out. This immediately lowers your credit utilization rate, and with good payment habits, your credit card issuer may automatically increase your credit line, which decreases your credit utilization rate even further.

6. Apply for a secured credit card

We don't recommend applying for new unsecured credit cards when your credit is in rough shape. We do, however, suggest considering a secured credit card.

Secured credit cards are ideal for building credit because they're much less likely to land you in debt, making them safer than regular credit cards. Rather than borrow money from your credit card company and repay it when you make payment, secured credit cards require you to make a deposit when applying. This usually becomes your credit limit.

Then, you essentially just borrow from this every time you make a transaction and pay it off when you get your bill. You can only borrow up to the amount you've already forked over at most. Most secured credit cards report your payment activity to the three major credit bureaus, so a positive history will work in your favor.

Check out our list of the best secured credit cards for some options.

7. Make payments twice a month

An excellent way to trick the algorithms, even if you spend a lot on your credit card monthly, is to make two monthly payments. So rather than waiting until the due date to pay the total amount due, pay half of the bill right away and the other half before the due date. This naturally keeps your credit utilization low and helps increase your credit score.

8. Consolidate your debt

If you have multiple credit cards with high interest rates, consider applying for a new credit card with a balance transfer promotion to consolidate your credit card debt.

This helps increase your credit score in a couple of ways:

- You'll have more credit available on the card you transferred from, lowering your credit utilization rate

- You may be able to afford higher monthly payments with the lower interest rate, paying your balance down faster

- You reduce the risk of missing a payment since you have fewer cards to manage

Balance transfer credit cards can be a great way to consolidate debt and save money you'd otherwise pay on interest charges. The promotional periods usually run from 12-21 months. For instance, the Citi Double Cash® Card offers a 0% intro APR on balance transfers for 18 months. After the intro period ends, your APR will increase to the regular interest rate of 17.49% - 27.49% (Variable), so make sure you have a plan to pay your balance off within the introductory time frame.

9. Ask to be added as an authorized user

If you have a close family member or friend you trust, you may ask them to add you as an authorized user on one of their credit card accounts.

Being an authorized user doesn't mean you have to use the card. As long as the credit card company reports authorized users to the credit bureaus, you can take advantage of your loved one's good credit to increase your score. This works best if the account has a long history of on-time payments with a low balance.

10. Don't cancel old accounts

Not closing old accounts is one of the easiest ways to increase your credit score, but many overlook this option. If you close credit cards, your credit history is shortened. The length of credit history shows lenders you have a long track record of using credit responsibly. That means the older the account is, the better it is to hang on to and not cancel your credit card.

It's okay to cut up the cards, burn them, and stomp on the ashes (or melted plastic), but don't close the account. Credit age makes up 15% of your credit score, and closing old accounts could lower your credit score. Even if you never use a line of credit, keeping it open could help mature your credit age.

Why is credit important?

Like it or not, there are many situations where credit scores matter. If you have bad credit, obtaining a loan or credit card could be more difficult, and you'll pay higher interest rates than someone with a good credit score. You may also have a harder time getting an apartment or landing a job if you have poor credit.

Your credit score is a number that allows potential lenders to decide whether you know how to manage your money. It directly represents your borrowing habits and payment history, so a lender can use your score to determine whether or not they want to do business with you. While this may seem a little heartless, financial institutions need to make decisions quickly, and this score makes their job easier.

This adds up to the simple fact that your credit score is important to your personal financial health. You should know how to keep your score in a healthy range so you can reap the financial benefits when you need them.

FAQs

Can I raise my credit score 100 points in a month?

It's possible to raise your credit score 100 points in a month by following good credit practices, such as paying down balances to reduce your credit utilization and not making late payments. It also makes sense to check for errors on your credit report. Reporting errors and having them removed could be a quick way to boost your credit score.

Does increasing your credit limit help your credit score?

While increasing your total available credit can boost your credit score indirectly, you're not likely to get approved to borrow more if your credit is poor, and we don't recommend it anyway if you have a history of borrowing more than you can afford.

However, if your credit is strong and you're just looking to improve it further, you can consider making a request for more credit. Having a higher credit limit can decrease your overall credit utilization ratio and positively impact your score, as long as you don't change your spending and borrowing habits, by showing creditors that you have an even greater runway for using credit but are continuing to spend within your means and keep your borrowing to a minimum. Just note that a credit limit increase can result in a hard credit pull and ding your credit score by a few points for up to two years, though your overall credit impact can still be positive.

What is the fastest way to boost credit score?

Here are ways to quickly boost your credit score:

- Check for and dispute errors on your credit report

- Pay your bills on time

- Regularly use your credit cards

- Pay down credit card balances

- Increase your credit limit on current credit card accounts

- Make regular on-time payments

- Get added as an authorized user

- Keep your oldest credit accounts open

Can a credit repair company help you increase your score quickly?

Credit repair companies might be able to help you increase your score quickly if they can get negative information removed from your credit report. In general, however, accurate negative information is difficult to remove, and it often takes time to increase your credit score.

Be wary of any credit repair companies that promise a dramatic credit score increase in a short time period, as they may be promising more than they can deliver.

How do you check your FICO score for free?

FICO has an "Open Access" program that allows financial institutions to provide free FICO scores to their customers. If you have a business relationship with one of the more than 200 participating partners, you should be able to obtain a free FICO score.

Other services, such as Experian Boost and SoFi®, provide free credit score access. Discover also offers free access to FICO scores, even for people who are not Discover customers.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

:format(webp)/images/2020/01/07/raise-credit-score-in-30-days.jpg)

/authors/angela-brown-headshot.jpg)

/authors/samantha-hawrylack-headshot.jpg)

/authors/becca-borawski-jenkins-fbz.jpg)

Add Us On Google

Add Us On Google

/images/2020/05/20/experian-logo.png)

/images/2025/01/27/rlogo_stacked_1224948_1.png)

/images/2024/04/17/1280x720-simplifi-logo.png)

/images/2025/01/27/rlogo_stacked_1224948_1.png)

/images/2024/04/17/1280x720-simplifi-logo.png)

/images/2024/12/13/discover_it_secured_card_art_-_12-13-24.png)

/images/2021/04/21/adobestock_192812280_1200x628.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2025/01/28/adobestock_628402894_1.jpeg)

/images/2024/09/04/adobestock_669069249_editorial_use_only_1.jpeg)

/images/2020/03/02/tattoo-woman-bar.jpeg)

/images/2020/12/21/smiling-couple-looking-at-laptop-screen.jpeg)

/images/2020/05/20/experian-logo.png)

/images/2023/01/26/man-working-repairing-his-credit-score.jpeg)

/images/2020/11/03/happy-professional-woman.jpg)

/images/2025/09/18/person_paying_with_credit_card.png)

/images/2018/06/07/how-to-build-credit-at-18.jpg)

/images/2019/07/16/african-woman-built-credit-in-her-20s.jpg)

/images/2020/01/28/self-lender-successful-woman.jpg)

/images/2022/03/16/loving_daughter_hug_mother_people_posing_looking_at_camera.jpg)

/images/2023/09/05/happy-couple-paying-bills-using-laptop.jpeg)

/images/2019/07/17/man-checking-his-credit-score.jpg)

/images/2022/09/19/credit_report_-_credit_cards_-_laptop.jpg)

/images/2021/01/12/enthusiastic-woman-with-laptop.jpeg)