Historically, credit scores have only included credit accounts, but what about your other recurring bills that you faithfully pay every month? Experian Boost®1 <p class="">Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more.<br></p> is a product designed to help with that.

Experian is one of the three national credit reporting agencies and arguably the most consumer-friendly one. This credit bureau offers access to your FICO® score and Experian credit report for free. TransUnion offers a free credit score based on the VantageScore model and Equifax doesn't offer one at all. You can access free reports for these bureaus on AnnualCreditReport.com.

Experian Boost helps factor your recurring payments into your credit score. The goal is to increase your credit score which improves your odds of getting approved for financing when you need it. Here's what you need to know about the product, how it works, and how it impacted my credit score.

What is Experian Boost?

Experian Boost was introduced in early 2019. According to the credit bureau, the program has helped millions of consumers raise their credit score by an average of 13 points.

Experian Boost works by adding qualifying recurring bills, such as utility bills, phone payments, and even your Netflix and other streaming subscriptions, to your Experian credit file. A positive payment history for these bills is then added to your payment history on your credit accounts, which could potentially increase your FICO® score.

Having a good credit score is crucial to your financial well-being. When you apply for credit, lenders assess your creditworthiness to determine whether you're eligible and what interest rates to charge. If you have a low credit score, you may have a hard time getting affordable financing, and it might even be tough to get approved at all.

For instance, if you decide to apply for a new credit card, the credit card issuer will review your credit score, and your chances of getting approved depend largely on how good your credit score is. The same is typically true with loans and other lines of credit.

How does Experian Boost work?

When you sign up for a free account with Experian, you can go through the process to potentially boost your credit score. At the start, it will ask you to connect the credit card or bank account you use to pay your bills. Again, this includes utility payments, telecom accounts, certain types of insurance, qualified rent payments, and streaming services like Netflix.

Experian will identify eligible payments, and you'll verify which ones you want to add to your Experian credit file. Once you've completed the process, you'll see your results immediately. Personally, my credit score did not increase after using Experian Boost, but given that the average score increase is 13 points, results likely vary.

If you're looking for a quick way to potentially improve your credit score, Experian Boost is probably worth considering. The service is free, and all you need to do to sign up is provide your name, address, and email. If you're don't have an account with Experian yet, you may also need to provide your phone number and the last four digits of your social security number to verify your identity.

In addition to Experian Boost, you'll also get free access to your credit report and a free Experian credit score, which is your FICO® score based on your Experian credit file.

The bureau's monitoring service will provide you with real-time alerts when changes are made to your credit report, such as new inquiries and accounts or changes to your personal information.

Pros of Experian Boost

Experian Boost can't help everyone, but there are some potential benefits for people who can take advantage of it:

- It's free: A lot of credit monitoring companies charge for their services. And while Experian does have some premium features you have to pay for, you can get FICO® score access, a free Experian credit report, and Experian Boost for free.

- It's easy: It doesn't take much to enroll. And, according to Experian, it only takes about five minutes to get your boost.

- You get instant results: If you're eligible to get a boost, you'll see your results immediately. Other strategies for improving your credit can take several months before you see a potential change.

- It can make a difference for many: If you have poor or limited credit, it can be tough to get approved for loans and credit cards. In the right situation, Experian Boost can add valuable information to your credit file and potentially increase your score enough to make a difference in your approval odds and interest rates.

Cons of Experian Boost

Although the product can make a difference for some, there are some key considerations to keep in mind:

- It's only Experian: This service doesn't impact your FICO® score based on your credit reports with Equifax and TransUnion.

- Not all lenders will see it: If a lender uses one of the common FICO® or VantageScore models and requests your credit report from Experian, the resulting score will reflect the results from Experian Boost. But, if they use an older credit scoring model or check your report from one of the other credit bureaus, the boost probably won't help.

- There's no guarantee: While the average result is a 13-point increase, there's no guarantee your credit score will increase. Credit score calculations are complicated, and adding cell phone and other payments to your credit file may not have as big of an impact as you think.

- Not all banks are supported: When I first tried to sign up for Experian Boost in 2019, it didn't support my bank. It does now, but it is possible you won't be able to connect your account.

Who is Experian Boost best for?

Anyone can take advantage of Experian Boost, but the people who may enjoy the benefits the most are consumers with thin credit files and poor credit. If you're looking to build your credit score or rebuild after you've made some mistakes, Experian Boost is a free and easy way to add some positive bill payments to your file.

Just remember that there are some limitations, and it won't necessarily boost your credit score. But when you're working to improve your credit score, anything that can help is probably a good thing.

How to sign up for Experian Boost

You can start the signup process by visiting Experian's homepage. Click the 'Start your boost' button to begin.

Experian will ask you to provide the last four digits of your social security number and your cell phone number. You'll receive a text to verify your identity. Then you'll provide your full name, current address (and possibly your previous address, if you haven't lived at your current place for six months or more), birthday, and email address. You'll also be asked to create a password.

With that information, Experian will match you with your credit report and score. Once you're in, you'll see your FICO® score. Click on it and scroll down to "Quick actions" where you'll find the option to start the boosting process.

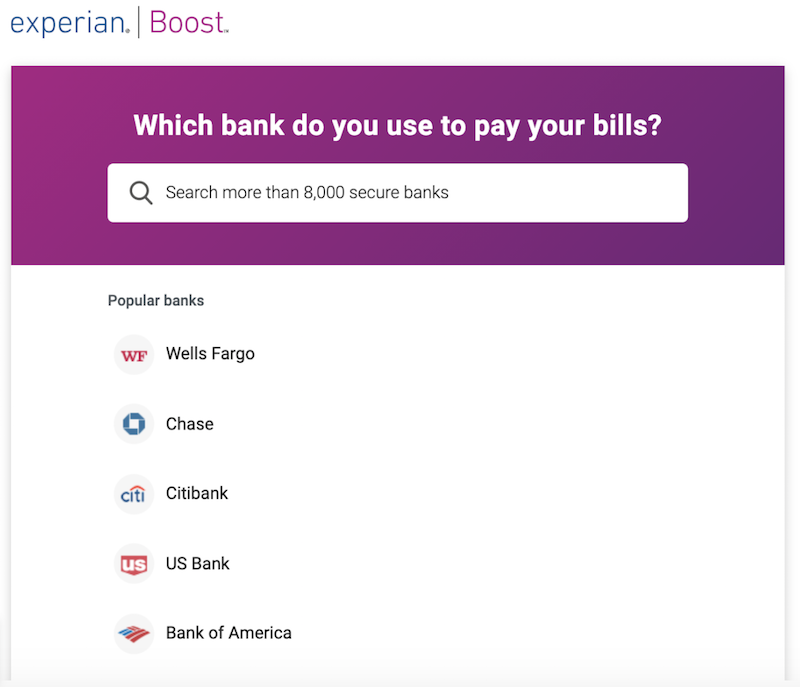

Experian also offers some information about the process, but you can skip the tutorial if you don't have a lot of time. Experian will ask you to find your bank and provide your login details to connect your account. For convenience, the credit bureau provides shortcuts for a handful of major U.S. banks.

You'll select the account that you use to pay your bills and click 'Continue' at the bottom of the page. If you use more than one bank or credit card account to pay various bills, you can also add those. Once you've connected all of your accounts, Experian will take a couple of minutes to scan until it finds payments it can use.

Specifically, the tool searches for bills that have a history of three or more payments over the last six months. If it finds something, it'll let you know and you can continue to the next screen.

Experian will show payments that it's ready to add to your credit file, as well as others that just need some more payment history to qualify or are pending for other reasons. At this point, you can review the accounts the program wants to add and decide which ones you want to include in your Experian credit report.

Updating my credit file took just a few seconds, yet my FICO® score ended up staying the same. Even without an immediate boost, however, Experian notes that your credit history benefits from more on-time payments, so not all is lost.

The credit bureau also notes that you can remove the information you added through Experian Boost at any time.

FAQs about Experian Boost

Can Experian Boost hurt your credit score?

Experian only searches your financial accounts for on-time payments, so it's highly unlikely your credit score will go down due to late payments. However, due to complex credit scoring algorithms, some consumers might see a slight drop in their score after connecting their bank account to Experian Boost. If that happens to you, you can disconnect your linked banks to return your score to its previous number. Of course, if you're like me, it is possible that the service won't impact your credit score at all. But on average, Experian says consumers get a 13-point increase.

Is Experian Boost safe to use?

Experian uses read-only access to your accounts and encryption to keep the information safe from hackers. It also doesn't store any information besides a record of your on-time payments, so you most likely won't have to worry about your bank information falling into the wrong hands.

Is Experian Boost free?

Yes, Experian Boost is a free service. The same goes for access to your FICO® score powered by Experian data and your Experian credit report. However, if you want more features, such as credit scores from the other credit bureaus and identity theft insurance, you'll need to upgrade.

Which is better, Experian Boost or Credit Karma?

Experian Boost is the only service out there right now that offers the chance to increase your credit score through the use of on-time payments as alternative credit data. For other services, however, Experian and Credit Karma may be comparable.

One key difference between Experian's and Credit Karma's monitoring services is that Experian offers a FICO® score and Credit Karma offers a VantageScore. While the VantageScore is helpful to understand the general health of your credit profile, lenders typically consider the FICO score in lending decisions.

That said, Credit Karma offers credit scores and credit report information from two credit bureaus, Equifax and TransUnion. With Experian's free tier, you only get access to your Experian data.

Given this, it could potentially be a good idea to have accounts with both services. That way, you can keep tabs on your credit files with all three credit bureaus.

The bottom line

Understanding your credit score and how to improve it is a key aspect of learning how to manage your money. Experian provides an important service by using alternative credit data to help improve your credit score with Experian Boost. While there are some limitations, it's free and easy to use.

Hopefully, the biggest impact of Experian Boost is a more widespread use of alternative credit data in the credit scoring and lending industries. This information could offer valuable insights into consumer financial behavior and make it possible for lenders to make better decisions about lending to people who may not have the highest credit score but are managing their recurring monthly payments responsibly.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2021/02/16/excited-woman-with-credit-card.jpeg)

/authors/ben-luthi_uVgqu3a.png)

/authors/jess_ullrich.jpg)

/images/2020/05/20/experian-logo.png)