If you want the benefits of traditional banking, but you've been denied a bank account or don't want to open a new one, Amex Bluebird has a solution for you. This nearly fee-free card account is one of the best prepaid debit cards available. It provides typical banking services without the high fees you often see from traditional banks.

Amex Bluebird offers money management solutions to help with your finances on an everyday basis. There are no monthly fees, no overdraft fees, and you're free to use your Bluebird card just about anywhere American Express credit cards are accepted.

Here, we'll look at what Amex Bluebird is, how it works, and whether you should consider signing up for a free Bluebird account.

What is Amex Bluebird?

Based on consumer feedback from an initial pilot program in 2011, Amex Bluebird was launched in 2012 as a banking alternative partnership between American Express and Walmart. Consumers felt traditional banking services were becoming less valuable and more expensive, so Bluebird presented a viable money management solution with fewer fees.

According to the Federal Deposit Insurance Corporation, more than 8.4 million U.S. households had no access to a checking or savings account in 2017. Today, Bluebird helps serve these households and anyone else who wants a simple and straightforward banking alternative.

Bluebird funds are protected by FDIC insurance (after about one business day from the deposit), and the program is backed by American Express, one of the largest credit card issuers in the world. If you need banking services from a non-bank, Amex Bluebird is a legitimate option.

How does Amex Bluebird work?

Amex Bluebird is not a bank account and it's not issued by a bank. It does, however, function similarly to a debit card with a checking account. With Amex Bluebird, you receive a reloadable card that attaches to your online account. Once you add funds to your account, you can use your card to pay for purchases in stores and online as long as the merchant accepts American Express cards. Use the card like any of the American Express credit cards, not a debit card with a PIN.

Access your Bluebird account at any time through the Bluebird website or the Bluebird mobile app. This makes it easy for you to use all of Bluebird's tools, including:

- Personal accounts: Manage your finances with direct deposit, bill pay, and mobile check capture. Check your account balance and use the Insights tools to track spending and financial goals, create budgets, and set spending alerts. You can have up to five Bluebird accounts at one time.

- Family accounts: Give up to four Bluebird cards to anyone (13 years or older) you want. Choose and set their spending limits and alerts, ATM access, and more.

- SetAside accounts: Set money aside for a specific purchase or event (like a vacation) in a SetAside Account. Transfer funds from your available Bluebird balance to a newly created SetAside Account to keep that money readily available when you need it. Once you're ready, transfer the funds back to your available balance, and they'll be ready for use. Set up a recurring transfer to a SetAside Account to build its funds.

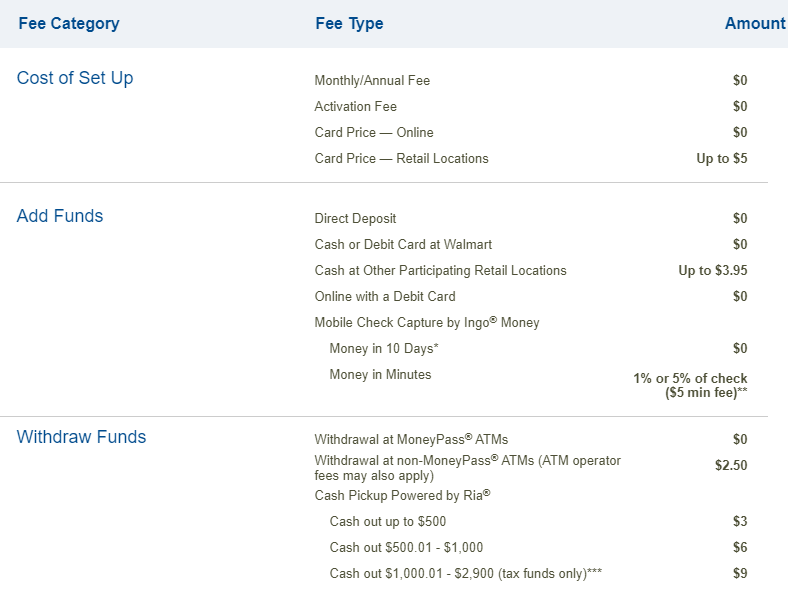

Although your Bluebird account carries no monthly or annual fee, there are still fees attached to it. But if you're careful about how you use Bluebird, you may be able to avoid most (or all) of these fees.

Setting up your Bluebird account won't cost a thing if you do it all online. You can buy a setup kit at Walmart, but that costs $5. When you add funds to your card, you'll be charged only if you're depositing by cash or debit card outside of Walmart, or if you want a mobile check deposited in minutes instead of days. The best way to avoid fees when withdrawing funds is by using MoneyPass ATMs. Because there are more than 32,000 MoneyPass ATM locations across the country, you should be able to find one nearby when you need it.

Bluebird charges no fees for making payments unless you purchase a checkbook with 40 checks. Sending money is free between Bluebird accounts. There are also no fees for inactivity, customer service calls, or getting a replacement card.

Who is Amex Bluebird right for?

Because Amex Bluebird is free (when you sign up online) and has very few fees, it's an excellent option if you want bank-like services without actually opening a bank account. You may have been denied a bank account or you don't want to pay bank fees, which is where Bluebird comes in. You can use it to deposit your cash into an FDIC-insured account, withdraw it when you need, and set aside money for specific purposes.

In addition, Amex Bluebird has interesting features that can be helpful for your family. If you want to provide family members with a reliable source of money for whenever they need it, set up family accounts for them. You can control spending limits and ATM access on each account.

Amex Bluebird is not a checking or savings account, so don't expect to earn money from interest over time. If you prefer to earn interest, a high-yield savings account might be a better option.

What we like about Amex Bluebird

- No hidden fees: What you see on the Amex Bluebird fee chart is exactly what you get. There are no monthly, annual, or overdraft fees, and most services are free. If you're careful, you can avoid most fees. You can do this by using only MoneyPass ATMs, sticking to Walmart if you're adding funds via cash or debit card, and sending money between Bluebird accounts.

- Bank benefits: Bluebird gives you many of the traditional benefits of a bank without having to open a bank account. You can use it to deposit money, withdraw cash, and pay bills. Even better, the money you deposit into your Bluebird account is FDIC insured after about one business day.

- Card membership benefits: Although Bluebird may not be a bank, it's run by a large credit card company: American Express. As an Amex Bluebird cardmember, you receive additional benefits, such as roadside assistance, purchase protection, and emergency assistance.

- Family accounts: Establish up to four Bluebird accounts for members of your family. With this unique benefit, you can make sure your family members have access to money when they need it. You can also set their spending limits and ATM access accordingly.

- Easy to use: Access your online account whenever you need to through any web browser or the Bluebird mobile app. Use mobile check deposit to easily add funds to your account from wherever you are. All Bluebird settings are just a few clicks or taps away.

- Widely accepted: Bluebird is accepted almost everywhere American Express cards are accepted, which is about 99% of merchants that accept credit cards in the U.S., according to the Nilson Report.

What Amex Bluebird could do better

- Offer better savings: At the moment, Bluebird doesn't offer any savings. Yes, you can "save" money in a SetAside account, but it doesn't actually grow — it's just money that's sitting there. It's more of an organizational tool than a money-saving tool.

- Redo mobile check process: Mobile check deposit is an innovative tool that saves a lot of time. However, waiting 10 days for your money to deposit into your Bluebird account is a long time. If you want it quicker, you'll have to pay a steep 1% or 5% fee.

- Reduce fees on transfers: It's nice to have transfer options with Bluebird, but unless you're transferring to another Bluebird account, you're going to pay a fee. With so many money transfer options out there (PayPal, Venmo, Zelle, etc.), this process seems a little outdated.

How to sign up for Amex Bluebird

There are three ways to sign up for an Amex Bluebird account:

1. Buy a $5 Bluebird Account Setup Kit from Walmart

This option is fairly straightforward. Walmart sells Bluebird kits for $5, which will guide you through the process of setting up a Bluebird account. You'll have to access your online account eventually, even if you buy this kit, so it makes more sense to save $5 and do one of the next two options instead.

2. Register for a Bluebird account online at the Bluebird website

Follow these steps to register for a Bluebird account on Bluebird.com:

1. Navigate to the Bluebird homepage and click on "Open An Account"

2. Go through the process of registration, where you'll have to input:

- Your name, email address, home address, and phone number

- A username and password

- New ATM PIN and security questions

3. Check the box at the bottom of the form and click "Agree and Submit"

3. Register for a Bluebird account through the Bluebird mobile app

Follow these steps to register for a Bluebird account through the Bluebird mobile app:

1. Download the Bluebird mobile app in the App Store or Google Play

2. Open the Bluebird mobile app and tap "Register now"

3. Fill out the registration form, including:

- Name, email address, home address, and phone number

- A new username and password

- Date of birth and Social Security number

- New ATM PIN and security questions

4. Check the confirmation box at the bottom of the form and tap on "Agree and Submit"

How to add funds to your Amex Bluebird account

Load money onto the card through these methods:

- Direct deposit: Select "Set up Direct Deposit" in your Bluebird account to access your account and routing numbers. Then use these numbers to set up direct deposit through your employer. You can also print out the Bluebird Direct Deposit Form if that's what your employer needs to get direct deposit set up.

- Tax refunds: Set up your tax refund through direct deposit if you want the funds to go directly into your Bluebird account when they're ready.

- Linked debit card: Verify your debit card information in your Bluebird online account to add money from a debit card.

- Cash deposit at Walmart: Go to a Walmart register and request a cash deposit to your Bluebird account. You can add between $1 to $1,999 per day for free at Walmart.

- Mobile check: Add checks directly to your Bluebird account with Bluebird's Mobile Check Capture feature.

FAQs about Amex Bluebird

Is Bluebird from American Express a credit card?

Bluebird from American Express is not a credit card. It's a prepaid debit card that offers many similar functions and services as a conventional bank debit card. As you add funds to your Bluebird account, you can use your prepaid card to pay for bills and purchases up to the available balance in your account.

If you are looking for a credit card with valuable cashback earnings and a $0 annual fee, consider the Blue Cash Everyday® Card from American Express.

Can I withdraw money from Bluebird at Walmart?

For a fee, you can withdraw money from or reload money to your Bluebird account at any Walmart store in the U.S. or Puerto Rico. The service is called "Cash Pickup Powered by Ria." You can access this service through your Bluebird account on an online web browser or in the Bluebird mobile app.

Once you've completed the process, your money will be ready for pickup in as few as five minutes at the Walmart MoneyCenter. If you need help, ask for assistance at the Walmart customer service desk.

How much money can you put on a Bluebird card?

You can have up to a combined $100,000 total across your Bluebird accounts. The limits for adding funds are:

- Direct deposit: $100,000 per year for all Bluebird accounts

- Debit card(s): $200 per day; $1,000 per month for all Bluebird accounts

- Cash: $2,500 ($1,999.99 at Walmart) per day; $5,000 per month

- Receive/request money transactions: Up to $10,000 per month

- Mobile check capture: $5,000 per day; $10,000 per month

Can someone transfer money to your Bluebird account?

Anyone with a Bluebird account can transfer money from their Bluebird account to another Bluebird account for free. So if a friend or family member has a Bluebird account, they can use their account to transfer money to your account.

Can I earn interest on the money in my Bluebird account?

Bluebird is not a checking nor a savings account so your money in the account cannot earn interest.

If you are looking for a savings account with a reasonable interest rate that charges no monthly fees consider Chime®.1 <p>There’s no fee for the Chime Savings Account. Cash withdrawal and Third-party fees may apply to Chime Checking Accounts. You must have a Chime Checking Account to open a Chime Savings Account.</p> 2 <p class="">Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. <br></p>

Can you have two Bluebird accounts?

Yes, you can have two Bluebird accounts. You can have up to five Bluebird accounts total.

Other financial products to consider

Although American Express Bluebird has plenty of great features, cardmembers may miss out on a few benefits that come with bank accounts. If you want an account that earns you interest over time, consider the Chime account2 <p class="">Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. <br></p> 3 <p class="">Chime Checking Account is required to be eligible for a Savings Account.<br></p> or the Aspiration Spend and Save. Both of these accounts earn interest and offer helpful money management tools and services.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2020/08/04/woman-paying-bills-online.jpeg)

/authors/ben_walker_updated.png)

/authors/jess_ullrich.jpg)